What Does Financing Bad Credit Mean?

Before you request any individual funding for poor credit history, you require to check at the very least the term and also the rate of interest to identify if you will certainly be comfortable paying off the lending. With Glossy Cash Money Funding, you will certainly get a highly customized term to guarantee that you settle your car loan effectively.

This price integrates the primary amount, the rate of interest, the funding handling cost, or what lots of people call the lender fee. Considering that, at Glossy Cash Money Loan, we provide the very best rate of interest prices and very reasonable handling fees. We still believe that we have the most effective APR on personal fundings for poor credit history in the U.S.A..

Not known Incorrect Statements About Financing Bad Credit

The car loan agreement additionally describes the precise procedure for late repayments. A person ought to fully comprehend the treatment as well as any prospective effects before accepting the car loan. If you have a poor credit rating score as a result of a lack of credit scores background, individual car loans for bad credit score will certainly aid expand your credit rating.

Bad credit report Personal loans are exceptionally hassle-free. Unlike financial institutions as well as mainstream loan providers, the candidate never has to have a physical meeting during the approval process.

If you have an overdue account, you need to pay it prior to getting an individual car loan for negative credit rating. If you can not receive an individual loan for negative credit score, you must include a co-signer to the mix. A co-signer is a person with an excellent credit history and an excellent revenue.

The Basic Principles Of Financing Bad Credit

And all you need to do is finish the on the internet application to qualify for personal fundings for poor debt as much as an outrageous $5000. Do not let a negative credit history prevent you from living your life to its fullest. There are several factors why a person might need to look for an on-line financing.

Or it could be to stop their family members from getting in any kind of financial trouble. Whatever your factors might be, obtaining a bad credit scores funding today is a substantial action towards economic liberty. Personal fundings for poor credit report are now a staple in all corners of the US. Complete our finance application type, as well as you will understand why getting a funding, despite a bad credit report, is easier currently than ever before.

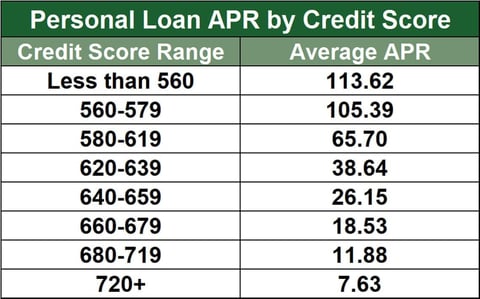

They are intended to help individuals who need a small quantity of cash in the short term, such as to pay for a medical emergency or individual costs. These car loans' APR and also other terms depend upon the customer's credit report. Typically, poor credit report personal loans have greater interest prices than conventional lending institutions.

The Only Guide to Financing Bad Credit

Some personal car loans can their website be obtained online, while others must be gotten personally. While getting a personal lending, you must supply necessary economic and also individual info to determine the finance's qualification. Most poor credit rating personal fundings are quick as well as very easy to fund. Getting a personal finance with bad credit history might appear tough.

These lenders will have their standards for a lending, however the keynote is to make certain that the person can pay back the money. Debtors can acquire these loans from financial institutions, credit report unions, or quick on-line lending institutions - financing bad credit. When looking for a finance, customers focus on factors such as the most affordable rate of interest, fees, and debt rating demands.

Finally, they ought to understand what type of lending they are requesting and also whether they will certainly require a co-signer. While most poor credit history lendings are secured, unsecured loans are also readily available. An unsafe poor credit scores loan why not look here can help you pay for emergency situation expenses if you don't have security. A poor debt finance typically has a fixed interest price and also will be repaid in month-to-month installments.

Financing Bad Credit Fundamentals Explained

Directly putting on a lending institution is likewise a choice. The downside to applying directly with a lender is that you just receive one funding offer. When you accept an offer, you can generally wait one company day before obtaining the financing profits. Keep in mind to settle the loan within the concurred timeframe.

It's best to use with a direct loan provider that concentrates on assisting individuals with bad credit rating. On top of that, regional lenders might have the ability to provide much more affordable terms as well as reduced charges than online loan providers. When contrasting personal car loans for bad Recommended Reading debt, it's essential to comprehend how much rate of interest they bill as well as for how long it will certainly take to settle the lending.

The Only Guide to Financing Bad Credit

Individual fundings likewise range in repayment terms from 24 months to 60 months. When it comes to acquiring a personal car loan, bad credit rating usually restricts your alternatives.

If you're late, you may find that you're subject to large costs and also fines. When getting a bad debt lending, ensure to consider a number of loan providers before determining which one will be the ideal for your situation. Lots of loan providers provide fundings to people with negative credit score, including cash advance and alternate installment loans.

Financing Bad Credit Things To Know Before You Buy

Personal fundings for individuals with negative credit scores are readily available from different resources, from cooperative credit union to on the internet loan providers. Cooperative credit union may need a lending institution subscription to use, yet you do not need to be a participant to shut the car loan. On the internet lending institutions commonly call for an online application and also documentation to verify your identity, address, and income.

This drop is particularly visible on higher scores. Late payment also increases the rate of interest, and also lenders might not want to forgo late charges. Several lending institutions use personal car loans for people with inadequate debt. Although the procedure is a bit more challenging than for individuals with ideal credit history, there are ways to obtain authorized for one.

Comments on “The Basic Principles Of Financing Bad Credit”